Final Report

Introduction and Objective

The volatility of financial markets has a key impact on socio-economic, national and government policies, and investor decisions, and the importance of money markets cannot be ignored. As a popular virtual currency with great investment opportunities and risks, different countries also have different policy attitudes towards it. The International Monetary Fund declared in February 2023 that “cryptocurrency is not granted legal tender status” and formulated corresponding action plans to maintain monetary sovereignty and stability. This indicates the widespread belief that the cryptocurrency market may have an impact on the fiat currency market, and that the complexities and possible forces involved have not been fully studied. This project will use the US dollar as a reference unit to explore the correlation between the cryptocurrency market and the foreign exchange market, looking for potential effects. Through data analysis and model forecasting, we try to assess this impact to provide market participants or any stakeholders with certain information to drive their thinking and decision-making. The research will focus on the predictive power and practical application possibilities of machine learning models, hoping to reveal valuable money market forecasting information.

Methodology Overview

To study the correlation and impact between cryptocurrencies and the forex market, we used the following key methods and techniques:

In the data collection phase, we used API to obtain data from yahoo finance, an authoritative financial website, for the 15 most market-dominant cryptocurrencies and 16 major forex, focusing on the daily adjusted close price changes of each asset from April 1, 2022 to January 1, 2024. All figures are in US dollars. We then cleaned and integrated the data set using python’s relevant packages to obtain return/volatility data in daily and weekly terms.

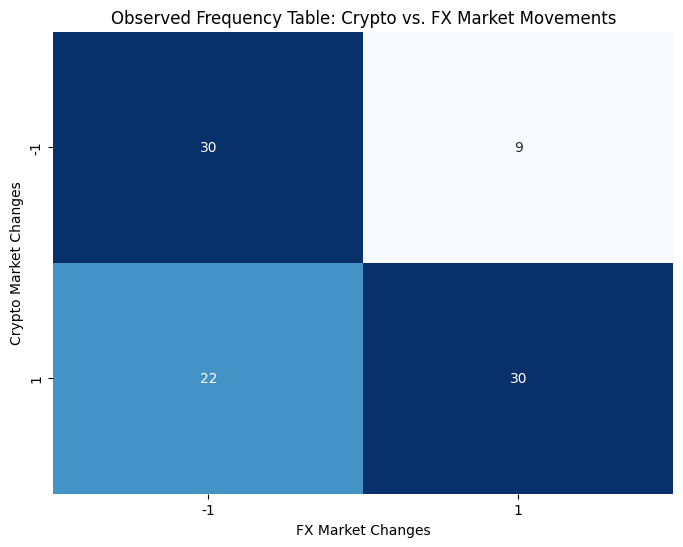

In the exploratory data analysis phase, we performed visualization and correlation analysis of volatility and hypothesis testing to gain an initial understanding of data structures and patterns, including histograms, pie charts, correlation matrices, linear regression scatter plots, and chi-square tests.

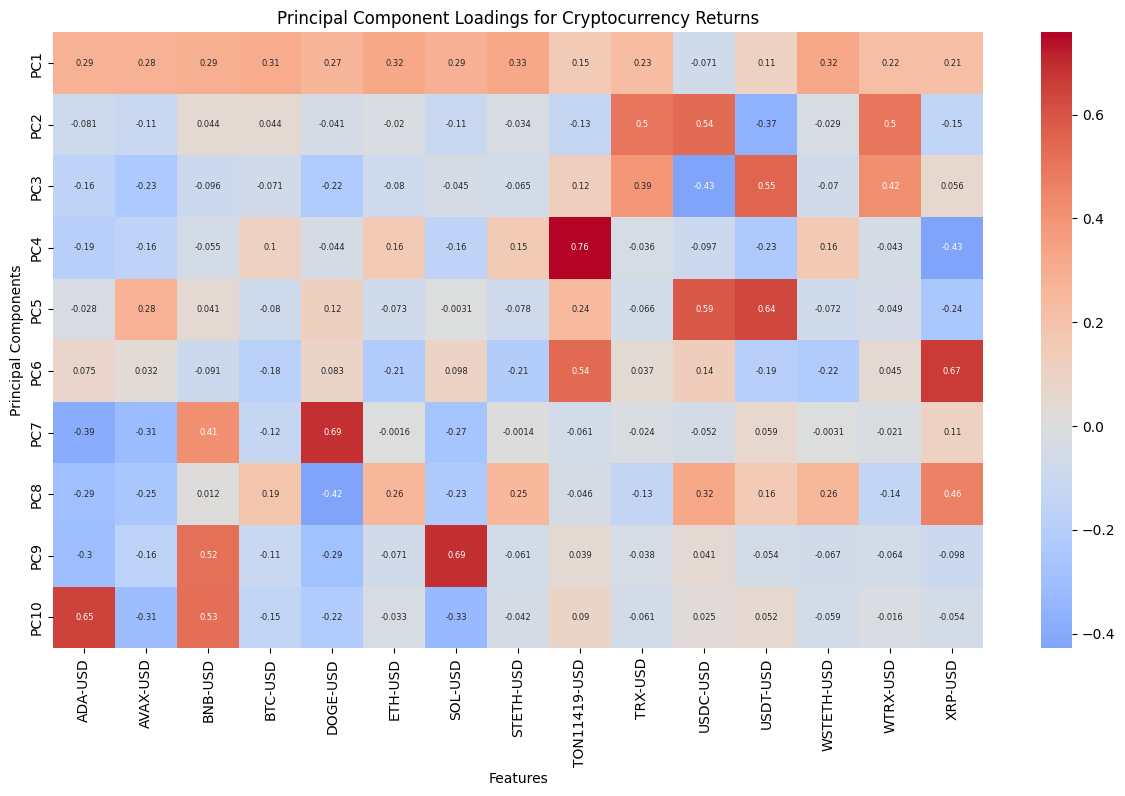

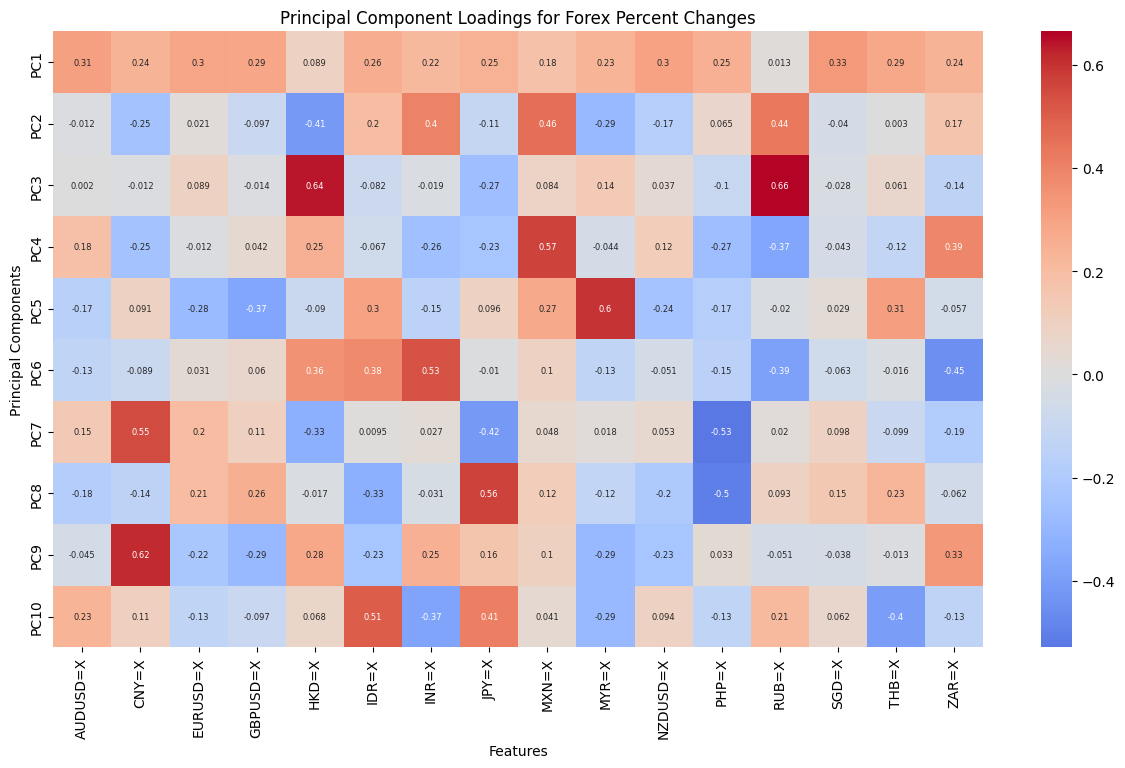

In the stage of machine learning, we used principal component analysis and t-SNE technology in unsupervised learning to observe linear and nonlinear patterns in the data, and then used K-means, DBSCAN and hierarchical clustering to further explore the classification of the data, supplemented by elbow rule and silhoulette score method as evaluation criteria.

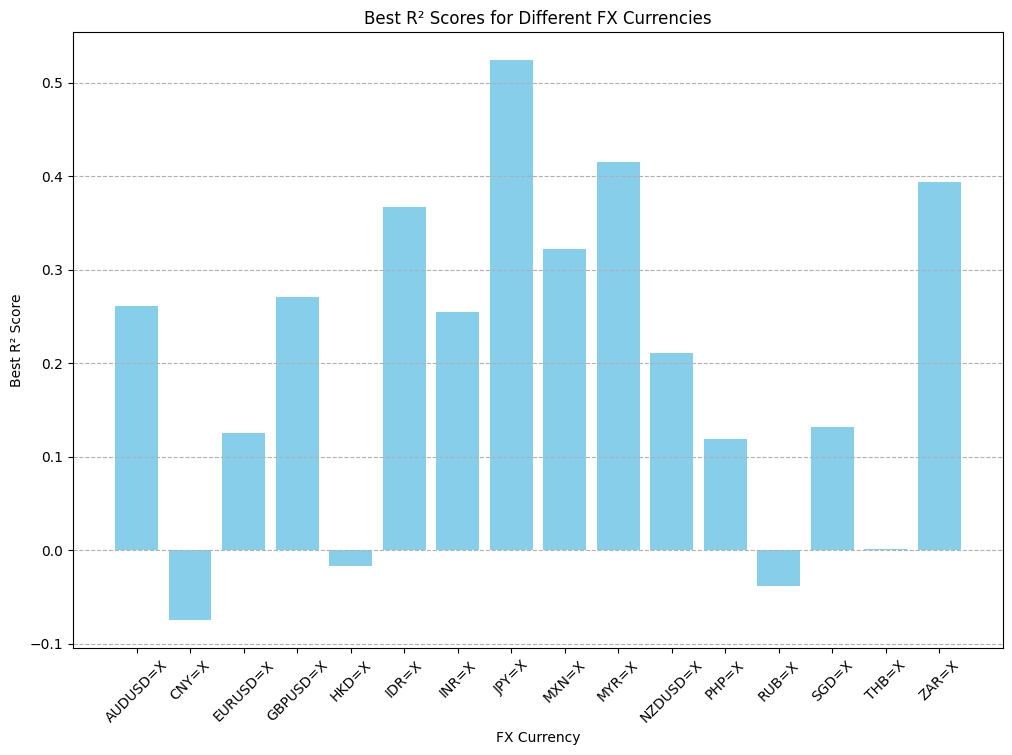

In supervised learning, we carried out regression analysis, binary classification and multivariate classification analysis for different analysis objectives. Regression analysis was used to predict the numerical volatility, using Linear regression, Ridge regression, Lasso regression, Random Forest and XGBoost regression models. Binary and multivariate classification analysis is used to predict market rises and falls or volatility ranges using Logistic regression, Support Vector Machines (SVM), Random Forest and XGBoost classification models. In the process of model evaluation, we divided the dataset into training and test set, and comprehensively evaluated the model through a series of performance indicators. In the regression analysis, we used the mean square error (MSE) and the coefficient of determination (R²) to evaluate the predictive power of the model. In classification analysis, we used accuracy, precision, recall, F1 score and ROC-AUC. In addition, we generated visual charts such as error distribution plots, residual plots, feature importance plots and confusion matrices to visually present the advantages and disadvantages of the models.

Key Findings and Visualization

Through data analysis and modeling forecasts of cryptocurrency and forex market volatility, we uncovered several key insights below.

Mainstream Cryptocurrencies Dominate Cryptocurrency Market Volatility Volatility in the cryptocurrency market is dominated by a few mainstream cryptocurrencies, while some other mid-sized or emerging cryptocurrencies may be more exposed to other independent factors.

Within the cryptocurrency market, there are also certain differences in the degree and pattern of volatility of different assets. Several currencies, such as Bitcoin, Ether, and Staked Ether, have a strong fluctuation correlation, while USDC and USDT, as stablecoins, have a very weak fluctuation correlation with other cryptocurrencies, and only have a certain correlation with each other.

- Globalization and Regionalization Characterize the Fluctuation of Foreign Exchange Market The overall volatility of the foreign exchange market is narrower and more stable, with the main factors of volatility concentrated in currencies involving global economies such as the Australian dollar, the Euro and the Singapore dollar, while the Hong Kong dollar and the Russian ruble show different pattern characteristics from most foreign exchange fluctuations. The fluctuations of the RMB and Philippine peso are less correlated with the fluctuations of the overall market, indicating that they are more influenced by regional factors.

- Correlation between the Two Markets Exists The results of the analysis show that there is a significant correlation between the volatility of the cryptocurrency market and the forex market, especially when both markets are trending down at the same time. The underlying structure of this correlation is complex and influenced by a large number of external factors.

- Varied Sensitivity of Fiat Currencies to Cryptocurrency Market Fluctuations The Japanese yen, the Mexican peso and the Indonesian rupiah have shown strong sensitivity to the volatility of the cryptocurrency market in several dimensions, while the volatility of the Chinese yuan, the Hong Kong dollar, the Russian ruble and the Indian rupee has very low correlation with the cryptocurrency market.

Implications and Discussion

Through the volatility analysis and modeling forecast of the cryptocurrency market and the forex market, the following implications are drawn.

The correlation between the volatility of the cryptocurrency market and the foreign exchange market means that stakeholders should take this interaction into account when investing, especially when there is a risk of market decline, the correlation will be further strengthened, and investors need to detect and respond in time, such as selling risky assets or buying hedging assets.

For investors in the cryptocurrency market, individual fiat currencies that show very low or negative correlation with the cryptocurrency market can be used as hedging assets to a certain extent. For example, when market volatility increases, investors can diversify their portfolio risks by increasing their holdings of Hong Kong dollars or Russian rubles, making total returns more stable.

The fluctuation of the foreign exchange market is influenced by both globalization and regionalization factors, and the policy makers can adjust their monetary policies according to the characteristics of currency fluctuations to reduce the risk of exchange rate fluctuations. For example, the exchange rate fluctuations of the RMB show a strong regional, while the Australian dollar is mainly influenced by global factors.

Data analysis and modeling forecasting can provide insight into the changes in the financial market to a certain extent, but there is still much room for improvement. This shows that there is a complex correlation between the traditional financial market and the digital market worthy of in-depth study, and future research can consider introducing more advanced deep learning models to improve the model’s predictive ability and learn more valuable information.

Conclusion

In conclusion, the research conducted on the volatility of the cryptocurrency and foreign exchange markets has revealed a significant and inextricable correlation between the two. Furthermore, fiat currencies such as the Japanese yen are highly sensitive to fluctuations in the cryptocurrency market, while the Russian ruble is more stable. It is essential for all stakeholders to consider the impact of inter-market fluctuations when making policy and investment decisions to reduce risk exposure. Finally, the modeling technology involved in this project has certain limitations, and the introduction of more advanced modeling methods may be conducive to the development of related research and output in the future.